Weekly Thoughts & Recap

I hope you are all well and enjoying your weekend.

This message is geared towards those in the course who are already taking and tracking trades and sending me a weekly recap.

If you are not there yet so long as you are working the course with me you will be there soon!

This is an exemplary model of what a weekly recap should look like including sending me your myfxbook link at the top in order for me to review. Put this type of work into yourself and it is going to pay off.

____

Hello Jordan,

I took 3 trades this week as shown here: https://www.myfxbook.com/members/your_personal_link_only_I_can_view

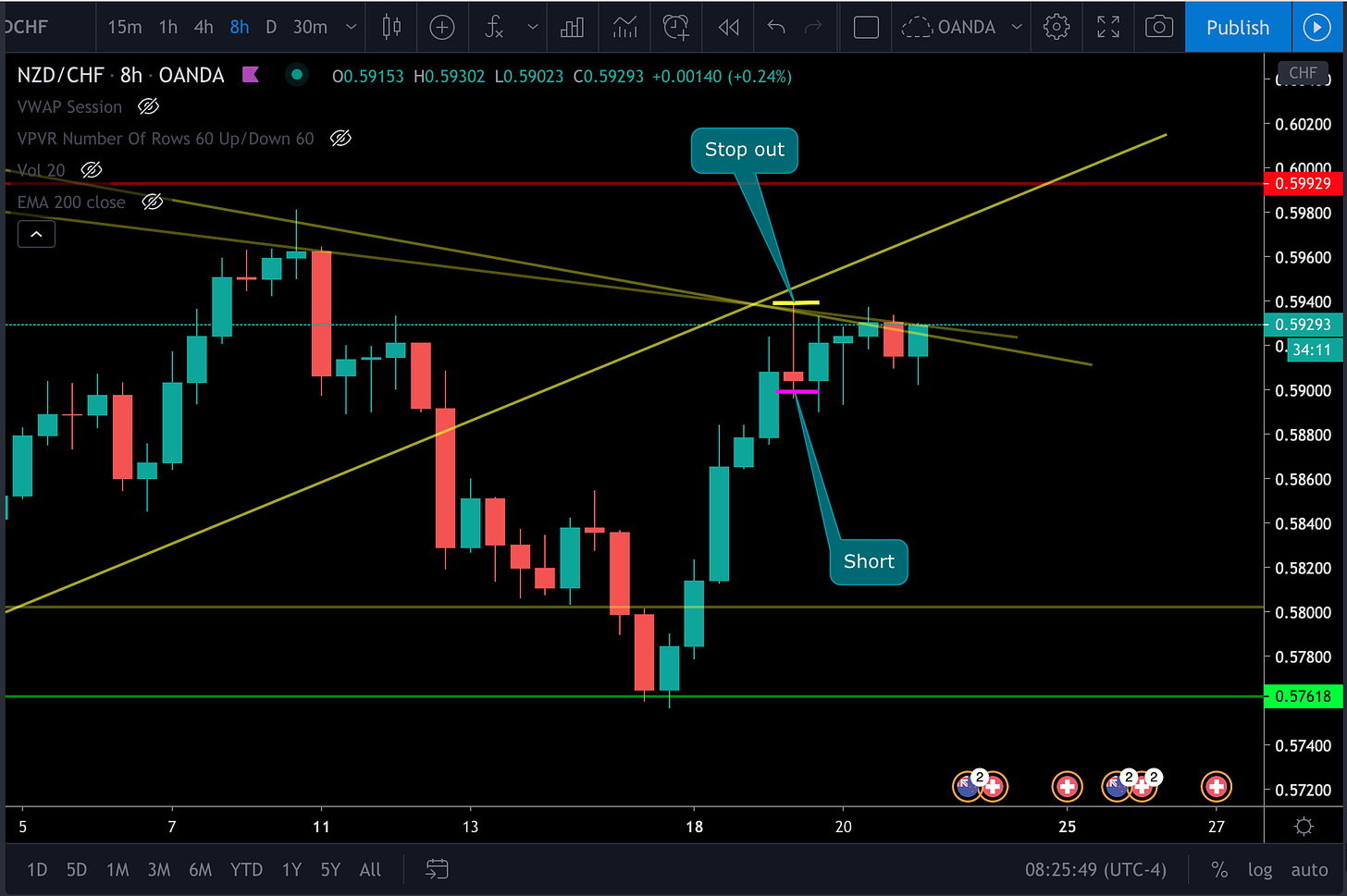

1. NZDCHF

My thoughts:

This could be a uptrend broken, retest and resume down

This could be a retest the trend line of a longer term downtrend and continue down.

I was impatient to wait for the next candle when I saw the 1st candle was rejected from the trend line.

My stop (0.59400) is too close. It ends up being triggered at the top of the candle (0.59389).

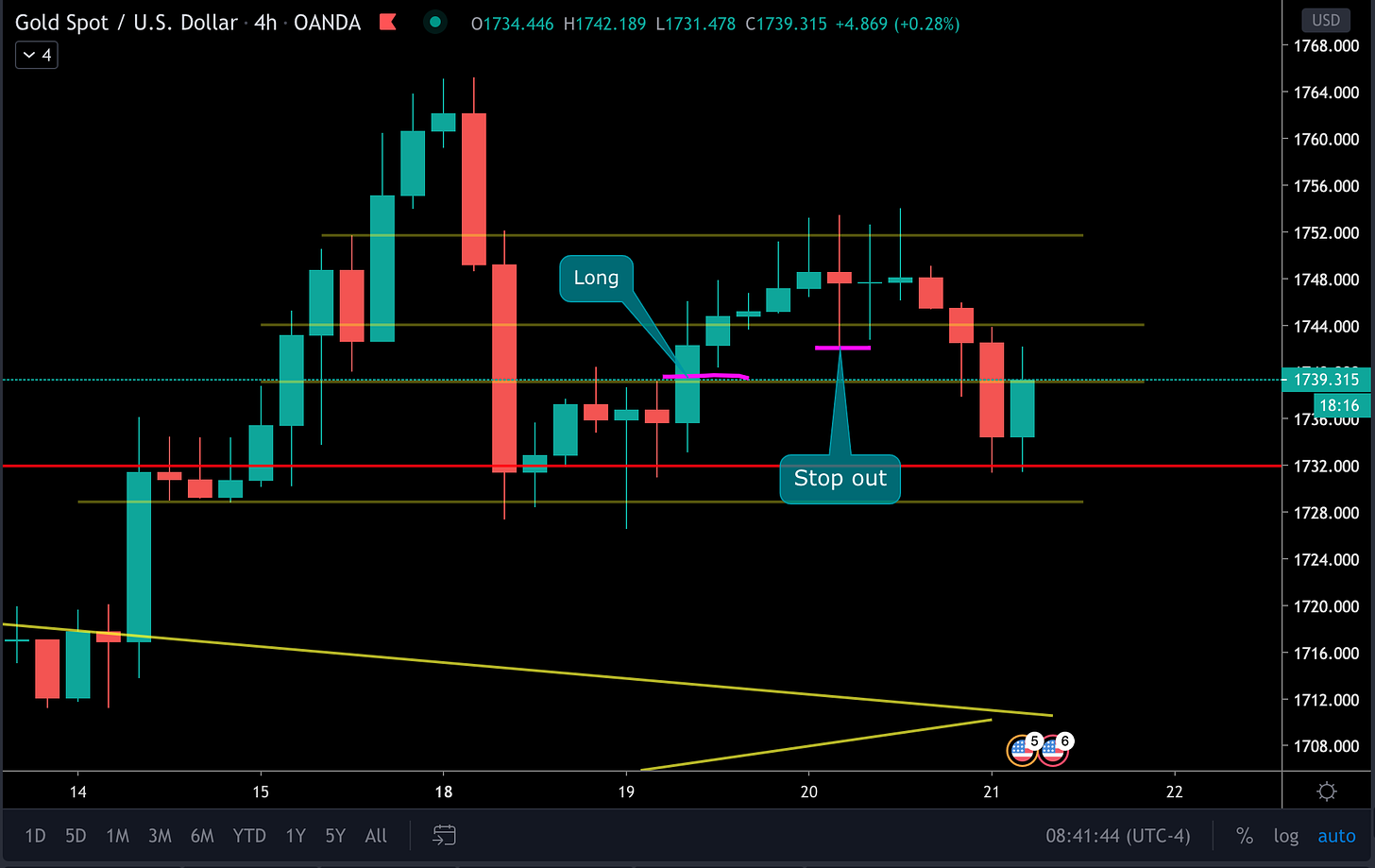

2. XAUUSD

My thoughts:

Breakout, retest and resume up

I might move my stop to BE too early?

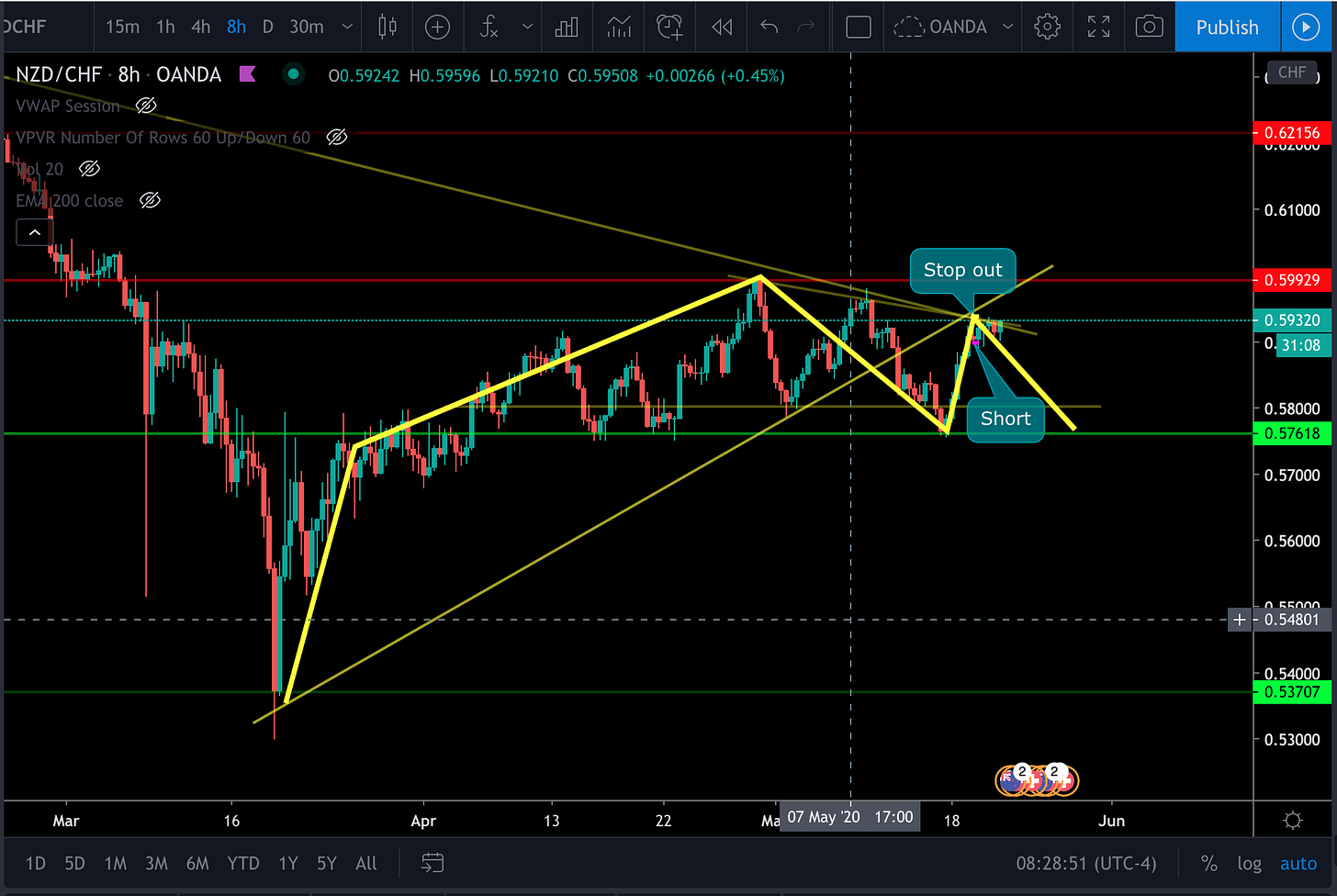

3. NZDCHF

My thoughts:

Same reasons as my 1st trade

I waited for the 2nd candle to turn red

My stop is made higher at 0.59700

Best regards,

____

Let me begin my affirming this is an exemplary model of what a weekly recap should look like including sending your myfxbook link at the top. This is going to pay off for you.

The NZDCHF was an excellent trade to take, take that type of trade over and over again and you will be on top. You don't need them all to work out.

Did you take it too soon? Maybe. Even if you took the next signal which again was a good one you would had been stopped out.

Regarding your stop loss being too tight in this current choppy market with tight ranges and little follow through widening your stop (and therefore lessening your position size) is very helpful.

Did you move your stop loss to breakeven on gold too early? Helpful hint when I enter a trade I don’t do anything until I am stopped out or I move my stop to b/e or lock in profits which is only as price approached the closest support or resistance level and not before. You have to give the trade room to play out for the exact reason you entered in the first pace.

Fantastic work!

Cheers,

Jordan